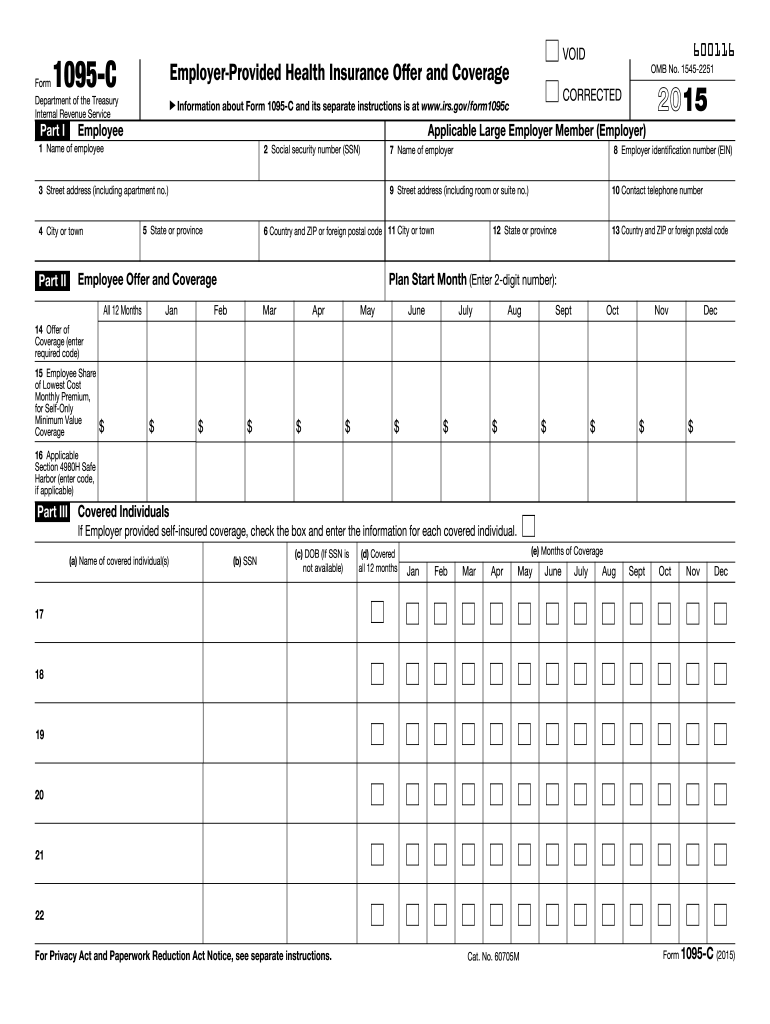

Title _f1095cpdf Author SBanken Created Date PMA 1095C documents will be mailed to active and former employees who were fulltime (worked an average of 30 or more hours per week) or were enrolled in the company's health insurance plan in by to the last updated address in our systemHow to complete Form 1095C In order to stay compliant with the Affordable Care Act in 16, companies with a fulltime staff of 50 or more will need to file a Form 1095C for each employee We'll help you figure out how it works

Landscaping Company Guide To Filing W2 And 1099 Forms Discount Tax Forms

Sample 1095 c form 2020

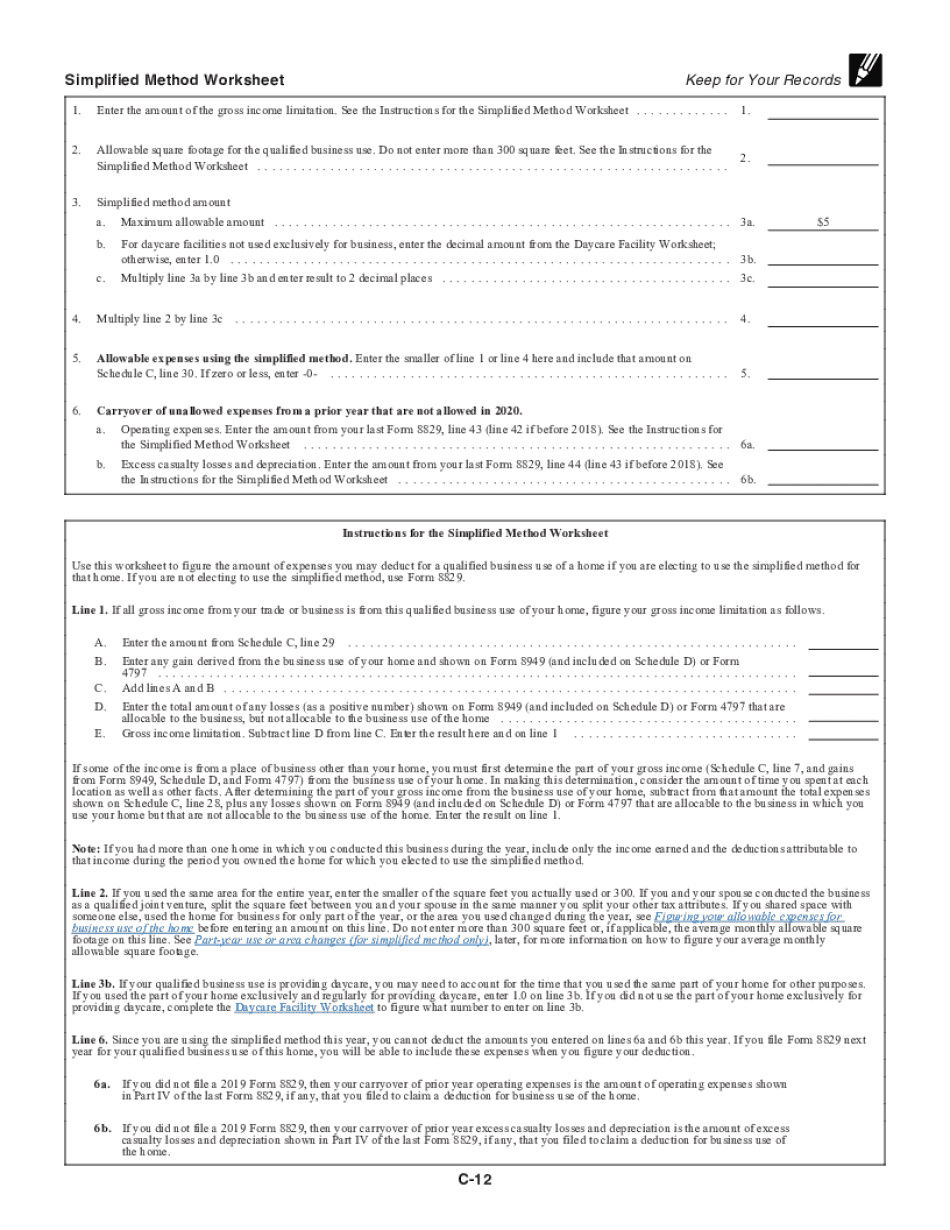

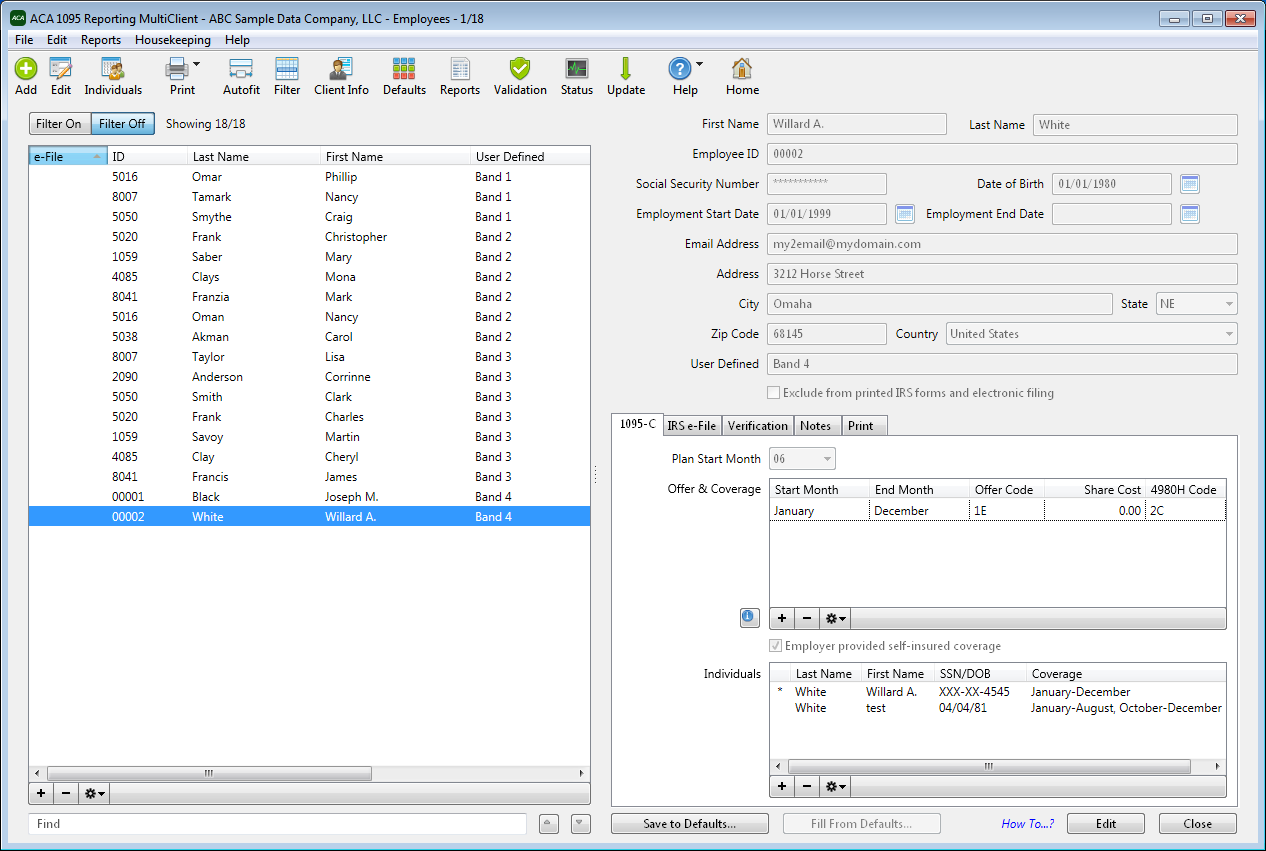

Sample 1095 c form 2020-Creating the 1095C spreadsheet to be imported Although you can create your own spreadsheet to import 1095C information for your clients' employees, we recommend that you use the 1095C template spreadsheet that we have made available for exportThe 1095C template spreadsheet exports from Accounting CS populated with basic employee information that is formatted to match the Sample 1095C HR360's sample letters include Explanations of why the employee is receiving Form 1095C Information included in the Form 1095C (including an explanation of Part III for selfinsured plans) Descriptions of why an employee may receive multiple Forms 1095C As a special bonus, we have also included a sample employee letter for use by small selfinsuring employers—generally those with fewer than 50 fulltime employees (including fulltime equivalent employees)—regarding Form 1095

1095 C Electronic Consent News Illinois State

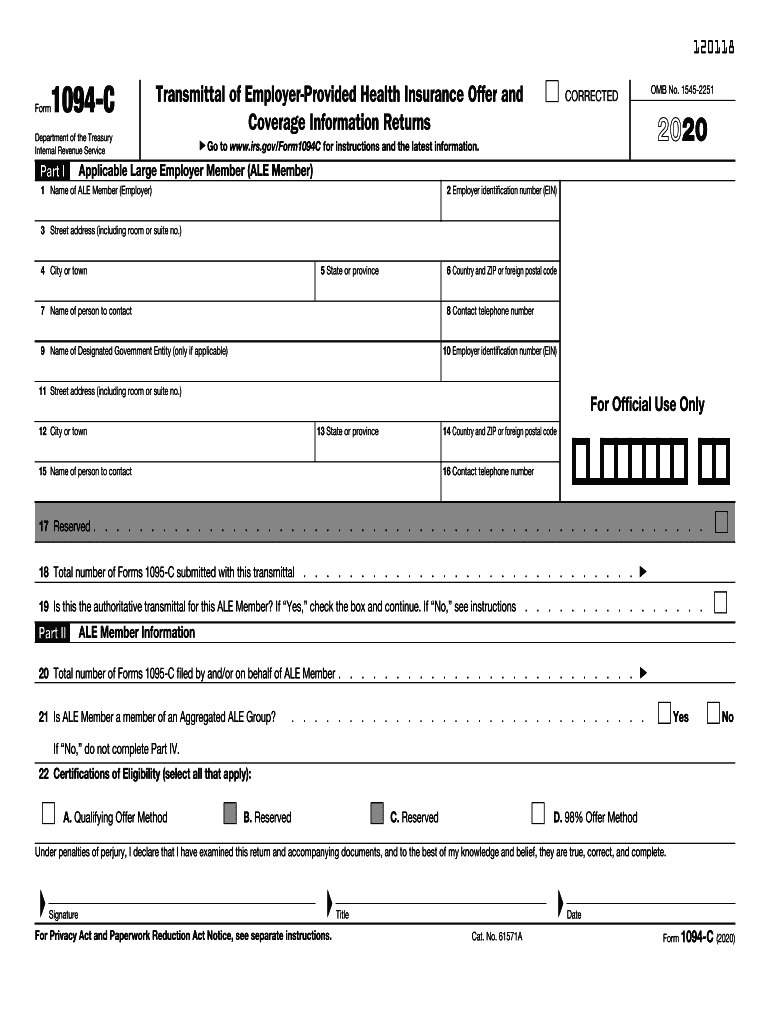

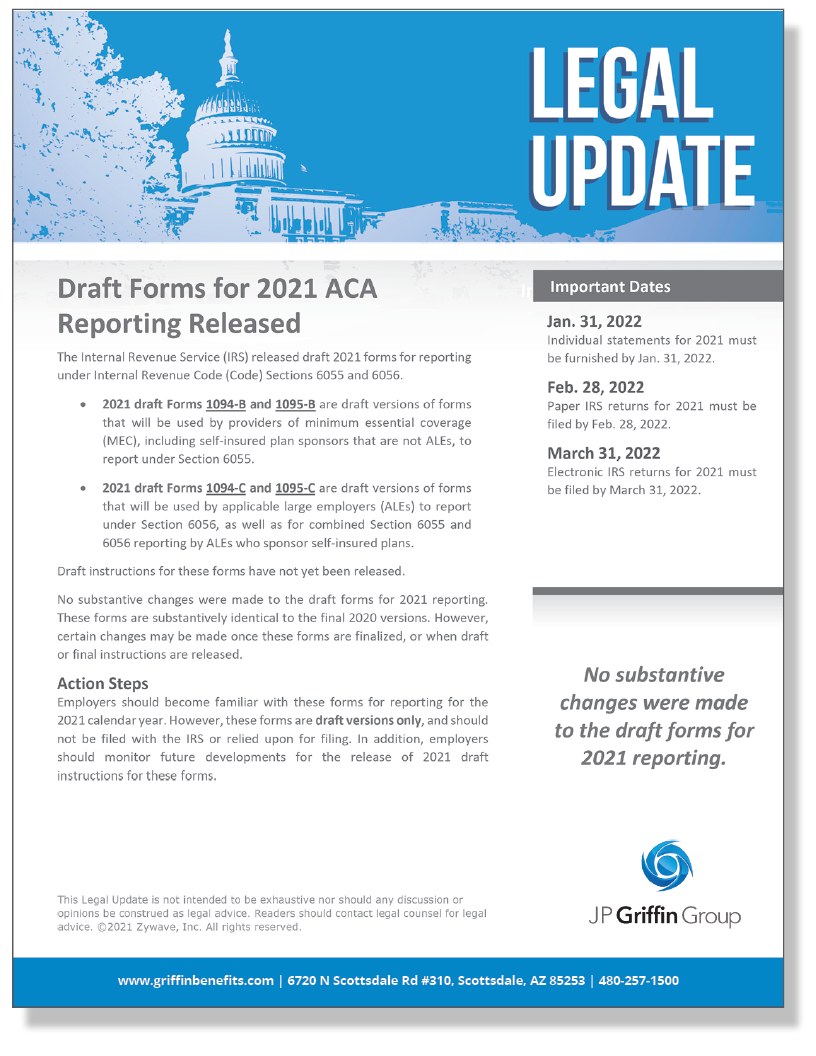

IRS released drafts of Form 1094C and 1095C for ALE Status Calculator Use this calculator to determine your ALE status Letter 5699 A helpful resource for the employer about letter 5699 Letter 226J Helpful resource on Letter 226J (ESRP) Blog Stay updated with the latest information Page 2 FTB Pub 35C (NEW ) California Instructions for Filing Federal Forms 1094C and 1095C References in these instructions are to the Internal Revenue Code (IRC) as of , and to the California Revenue and Taxation Code (R&TC) What's New Although employees received the same form last year, they may still have questions Is form 1095C required when filing taxes?

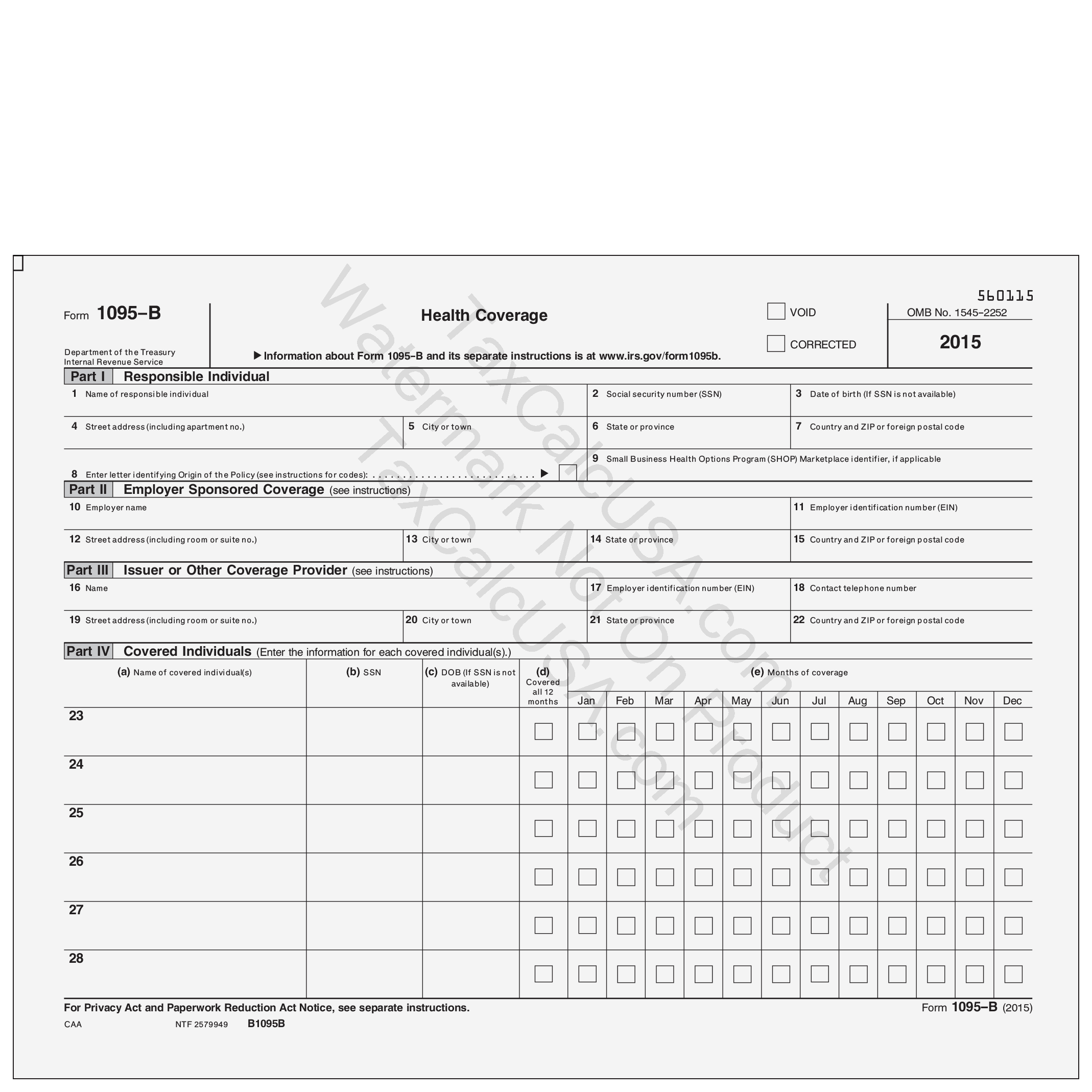

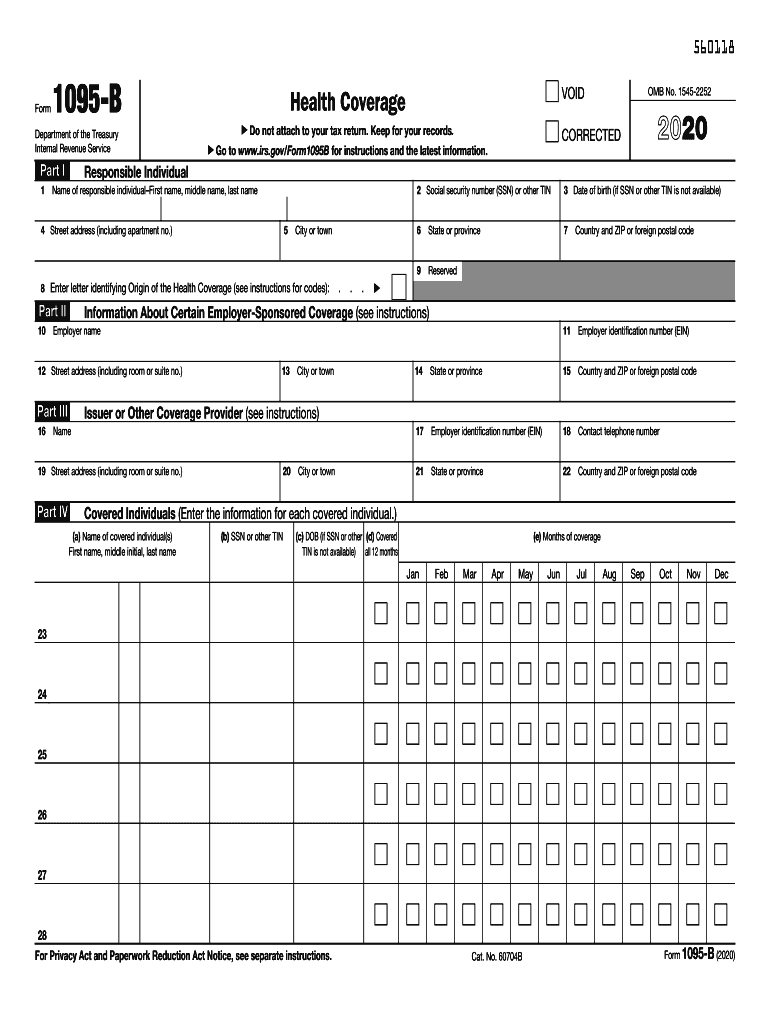

Step 5 Print Tax Form 1094C Click the top menu "Current Company" then the sub menu "Form 1094C" to view 1094C screen Note ez1095 software can print both 1095C and 1094 C forms for IRS and recipients on white paper No preprinted form is needed IRS changed form format in Year The Form has 2 pagesSample Form 1095B Form 1094C and Form 1094C Instructions Sample Form 1095C ACA 1094/1095 Reporting Requirements for 6 Guidance for Applicable Large Employers ACA 1094/1095 Reporting Requirements for 7 Coding Tips for 1095 Filings NAHU, the National Association of Health Underwriters, provided a webinar on this topic for theSample 1095C tax form Q How will I receive Form 1095C?

Reference Guide for Part II of Form 1095C Lines 14, 15, and 16 (revised for the final 17 forms) November 17 • Lockton Companies L O CKT O N CO M P ANIES GLOSSARY Children means an employee's biological and adopted children (including children placed with the employee for adoption), from birth, adoption, or placement through the end of the month in which the child1095c Departmant of Træsl_ry Internal RevenlÆ Service Part I Employee 1 Name of employ— Employee Smith 3 Stræt address apartment ro) 123 Maple Drive Unit 2 EmployerProvided Health Insurance Offer and Coverage Do not attach to your tax retum Keep for your records Information about Form 1095C and its separate instructions is at CORRECTEDWhen the 1095C must go out Sending out 1095C forms became mandatory starting with the 15 tax year Employers send the forms not only to their eligible employees but also to the IRS Employees are supposed to receive them by the end of January—so forms for would be sent in January 21

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

1095 C Printing Microsoft Dynamics Gp Forum Community Forum

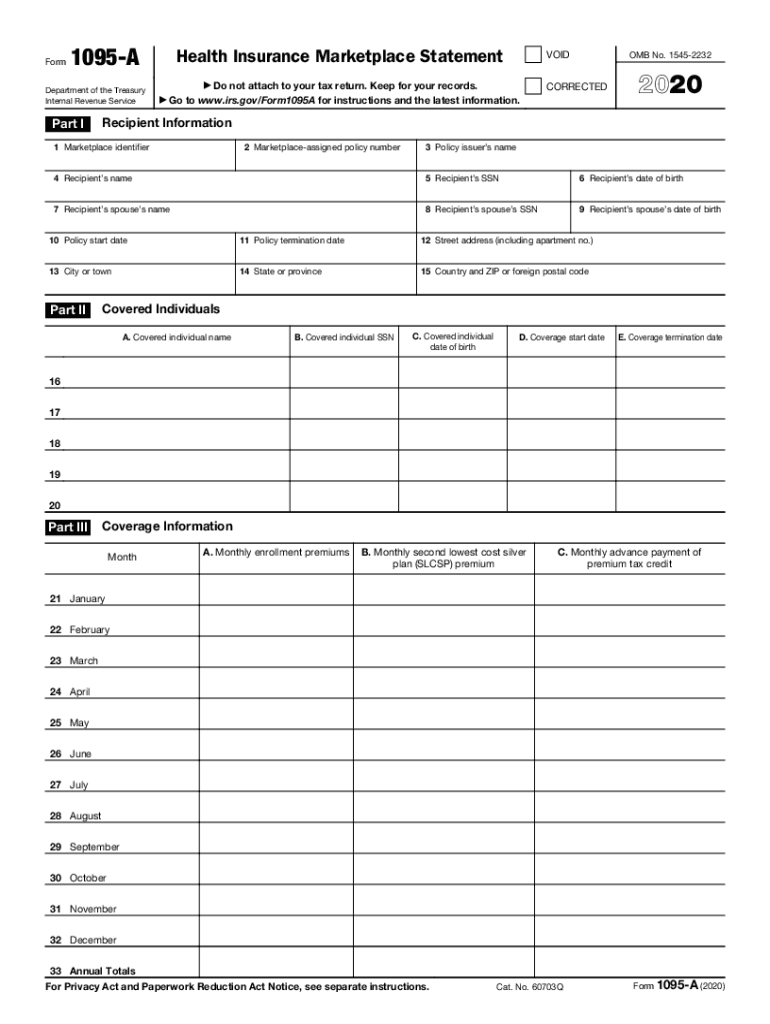

Form 1095A is provided here for informational purposes only Health Insurance Marketplaces use Form 1095A to report information on enrollments in a qualified health plan in the individual market through the Marketplace As the form is to be completed by the Marketplaces, individuals cannot complete and use Form 1095A available on IRSgovEz1095 is available for 21 tax season!This is required for the Form 1095C The Applicable Large Employer (ALE) must enter a twodigit number Additional Information For information related to the Affordable Care Act, visit IRSgov/ ACA For the final regulations under section 6056, Information

Employer Deadline To Furnish Forms 1095 B C To Plan Participants Extended To March 2 Sequoia

Guide For Viewing And Updating Payroll And Compensation Information Mass Gov

There is no longer a federal mandate to have health insurance and you do not have to file Form 1095C on your Tax return Prepare and eFile Your Taxes here on eFilecom 1095C If you and/or your family receive health insurance through an employer, the employer will provide Form 1095C by early March 2114" 1095C Pressure Seal Z Fold62 Review and update Form 1094C before mailing or efiling forms to IRS Note IRS changed form format in Year The Form has 2 pages Year 1519 form has only one page;

The Complete J1 Student Guide To Tax In The Us

Tmlhealthbenefits Org Forms Tml Displaydoc Aspx Doc Id 694 Form Webinar

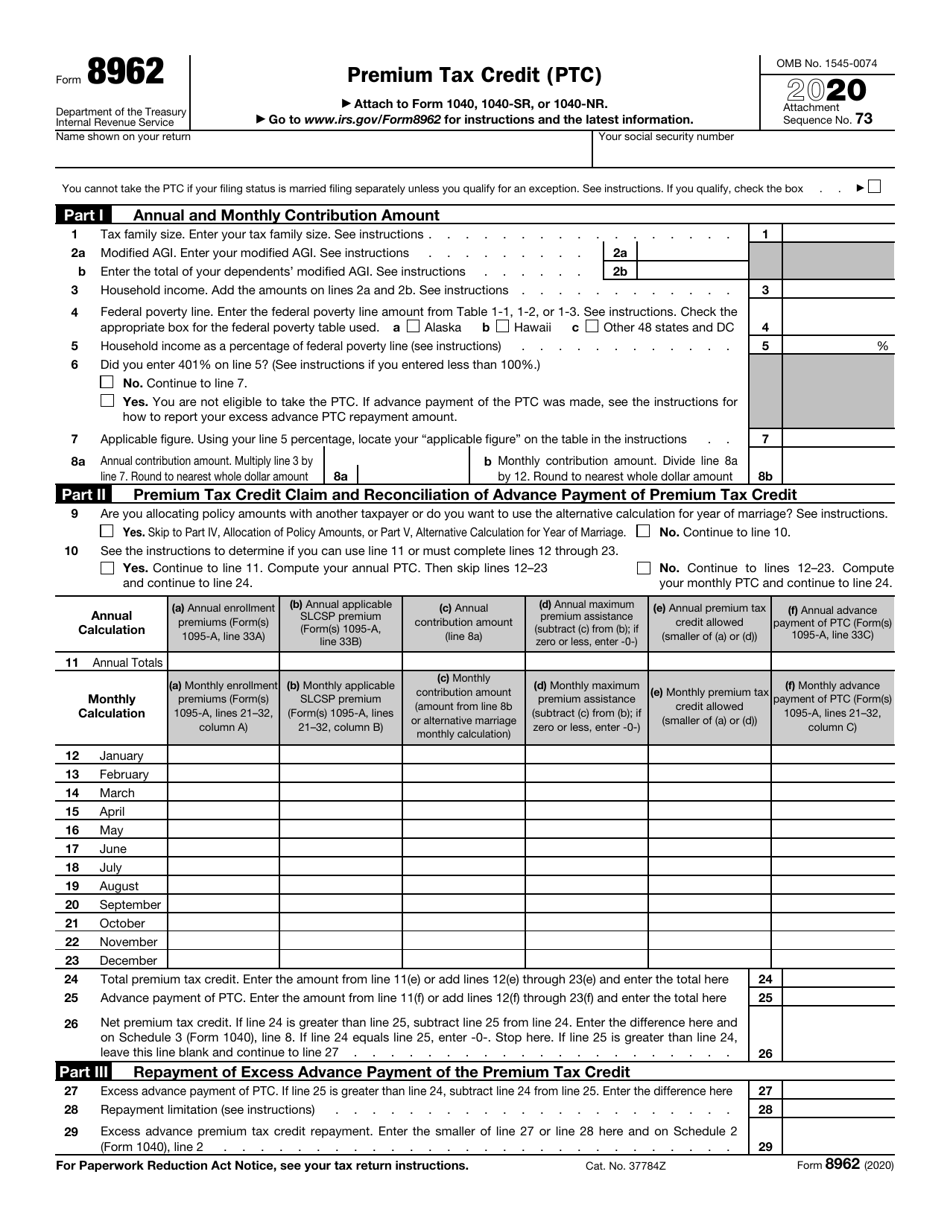

A figure called "second lowest cost Silver plan" (SLCSP) You'll use information from your 1095A to fill out Form 62, Premium Tax Credit (PDFForm 1095C Department of the Treasury Internal Revenue Service EmployerProvided Health Insurance Offer and Coverage Do not attach to your tax return Keep for your records Go to wwwirsgov/Form1095C for instructions and the latest information VOID CORRECTED OMB No Part I Employee 1 Name of employee (f 1095B/1095C ACA Filing "Print, Mail, & eFile" & "eDelivery/Print/eFile" orders must be completed by 3/2/21 at 7am (PDT) "eFile Only" orders must be completed by 12pm (Noon, PDT) on The IRS has officially provided notice that the deadline for furnishing (printing & mailing) IRS forms 1095B & 1095C is now extended to March 2nd

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Landscaping Company Guide To Filing W2 And 1099 Forms Discount Tax Forms

The good news for employees is that, like last year, the IRS will not require tax payers to submit a copy of form 1095C when they file their taxes Tax preparers may request a copy of the form, but it is not requiredForm 1095C EmployerProvided Health Insurance Offer and Coverage 19 Form 1095C EmployerProvided Health Insurance Offer and Coverage 18 Form 1095C EmployerProvided Health Insurance Offer and Coverage 17 Form 1095C EmployerProvided Health Insurance Offer and CoverageFilling out Form 1095C 2D The EE was in a Limited Nonassessment Period (LNAP) for the month 2E You are eligible for the multiemployer interim relief rule 2F The coverage you offered is affordable based on the Form W2 Safe Harbor 2G The coverage you offered is affordable based on the Federal Poverty Line safe harbor

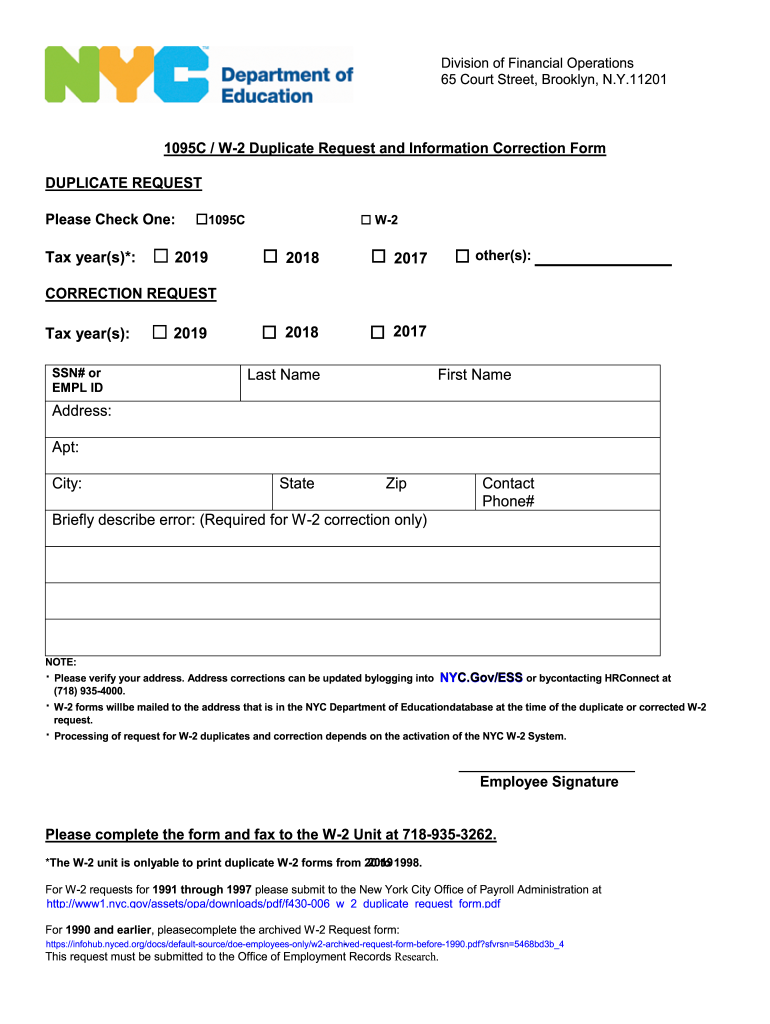

Need A Duplicate W 2 Or 1095 C Authorize Web Delivery Of Your Tax Forms Montgomery County Public Schools

Form Irs 1095 A Fill Online Printable Fillable Blank Pdffiller

Forms 1095B and 1095C Reporting Form Distribution to Employees Employers had until —extended from —to provide employees with copies of their Forms 1095B or 1095C1095C Form Download ACAPrime "C Forms" Template According to the IRS, as long as an employer obtains prior consent (electronically), the employer can distribute forms 1095C to employees through email or other other electronic method SampleWhat's on Form 1095A and why you need it Your 1095A contains information about Marketplace plans any member of your household had in , including Premiums paid;

trix 1095 C Efiling Process

Ny 1095c W 2 Duplicate Request And Information Correction Form 19 21 Fill Out Tax Template Online Us Legal Forms

IRS Form 1095C tax year changes include a new line 17, new offer codes and box for employee's age Form 1095C is now a 2 page form where Boxes 117 are listed on page 1 and the covered individuals are shown on page 2 Employee's age The IRS will now require an entry for the "Age" of each employee as of This will be inThe form 1095C for 21 is a form that is used to report information about the health coverage that an individual has In order to receive 1095 C Tax form credits or subsidies, the individual must have coverage that meets the minimum standards set by the Affordable Care Act Form 1095C is usually filed by the individual's employer Sample Excel Import File 1095B xlsx What's New for Line 8 Added new code "G" Individual coverage health reimbursement arrangement (HRA) Import Form Fields Field Name Size 1095B Form IRS 1095B Form

Payroll Office Grand Valley State University

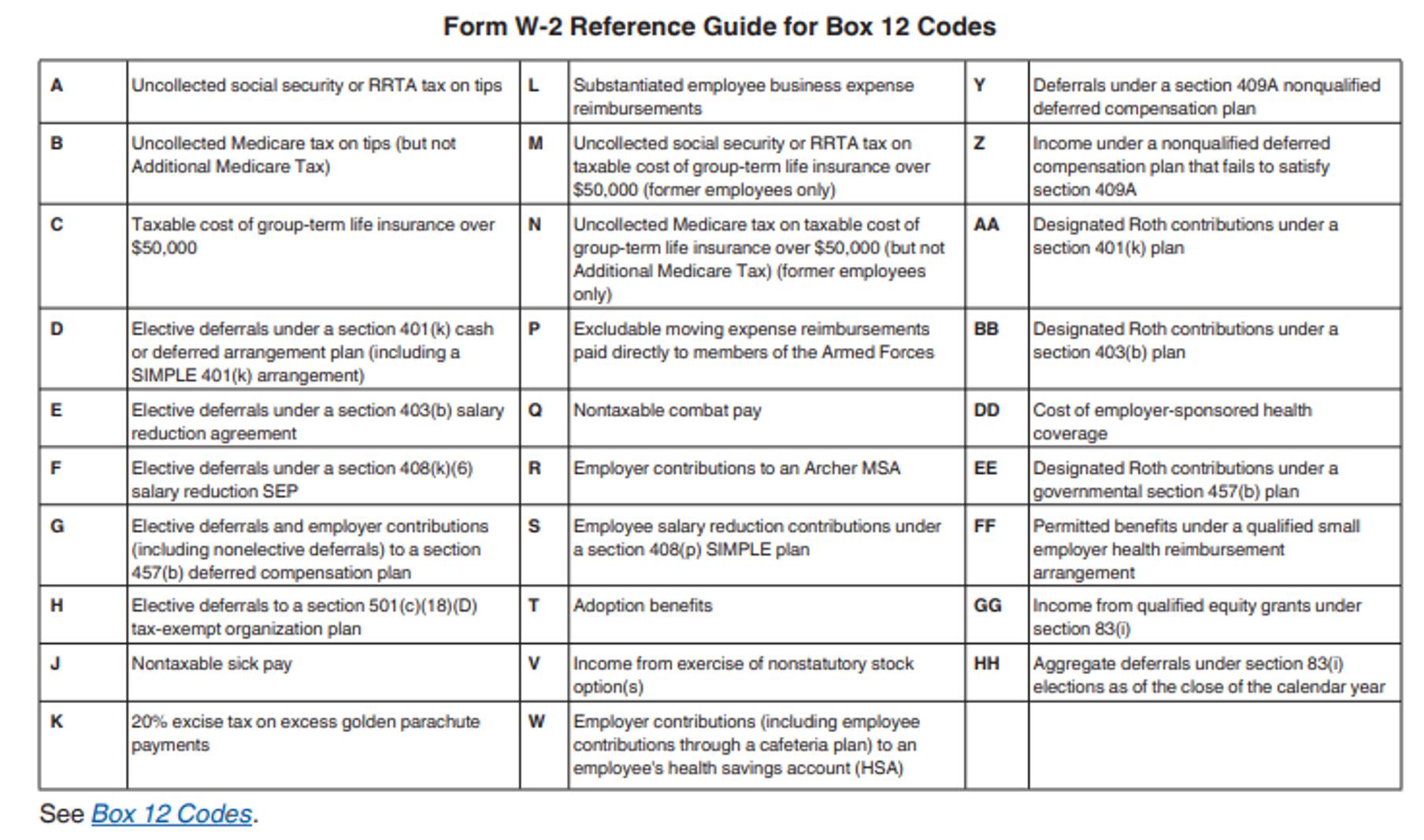

Form W 2 Filing Instructions Form W 2 Boxes

This ACA form 1095 printing software is compatible with Windows 10, 81, 8, 7, Vista and other Windows system, 32bit or 64bit Step 3 First time efiler test communication with AIR system by passing one of the eight test scenarios Self‐insured employers must report offers of COBRA coverage Employers complete Form 1095‐C providing COBRA coverage information (enrollment in COBRA coverage) How the Form 1095‐C is completed will depend, in part, on whether the employee was covered as an active employee during 18Inst 1094C and 1095C Instructions for Forms 1094C and 1095C Form 1095A Health Insurance Marketplace Statement Inst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement Form 1095

Employee Benefits Updates Archives Morris Garritano

Tax Information Access Health Ct

Next Next post Form 1095C Draft for Tax Year Released by IRS All content is for informational purposes only and does not provide tax advice BoomTax cannot guarantee that such information is accurate, complete, or timely Always consult an attorney or tax professional regarding your specific legal or tax situation Final Form 1094C Final Form 1095C Be sure to check out our most frequently asked questions pertaining to Form 1095C here Employers should remember that there are a number of new 1095C codes specific to the tax year1095c Form Department of the Treasury Internal Revenue Service Part Employee VOID EmployerProvided Health Insurance Offer and Coverage CORRECTED Do not attach to your tax return Keep foryour records Go to wwwirsgoWForm1095Cfor instructions and

Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

1095 C Electronic Consent News Illinois State

Instructions for Schedule C (Form 1040 or Form 1040SR), Profit or Loss From Business (Sole Proprietorship) Form 1040 (Schedule D) Capital Gains and Losses Inst 1040 (Schedule D) Instructions for Schedule D (Form 1040 or Form 1040SR), Capital Gains and LossesExample 1 Employer A, an ALE Member, files a single Form 1094C, attaching Forms 1095C for each of its 100 fulltime employees This Form 1094C should be identified as the Authoritative Transmittal on line 19, and the remainder of the form completed as indicated in the instructions for line 19, later Example 2Premium tax credits used;

Irs Form 1095 A Download Printable Pdf Or Fill Online Health Insurance Marketplace Statement Templateroller

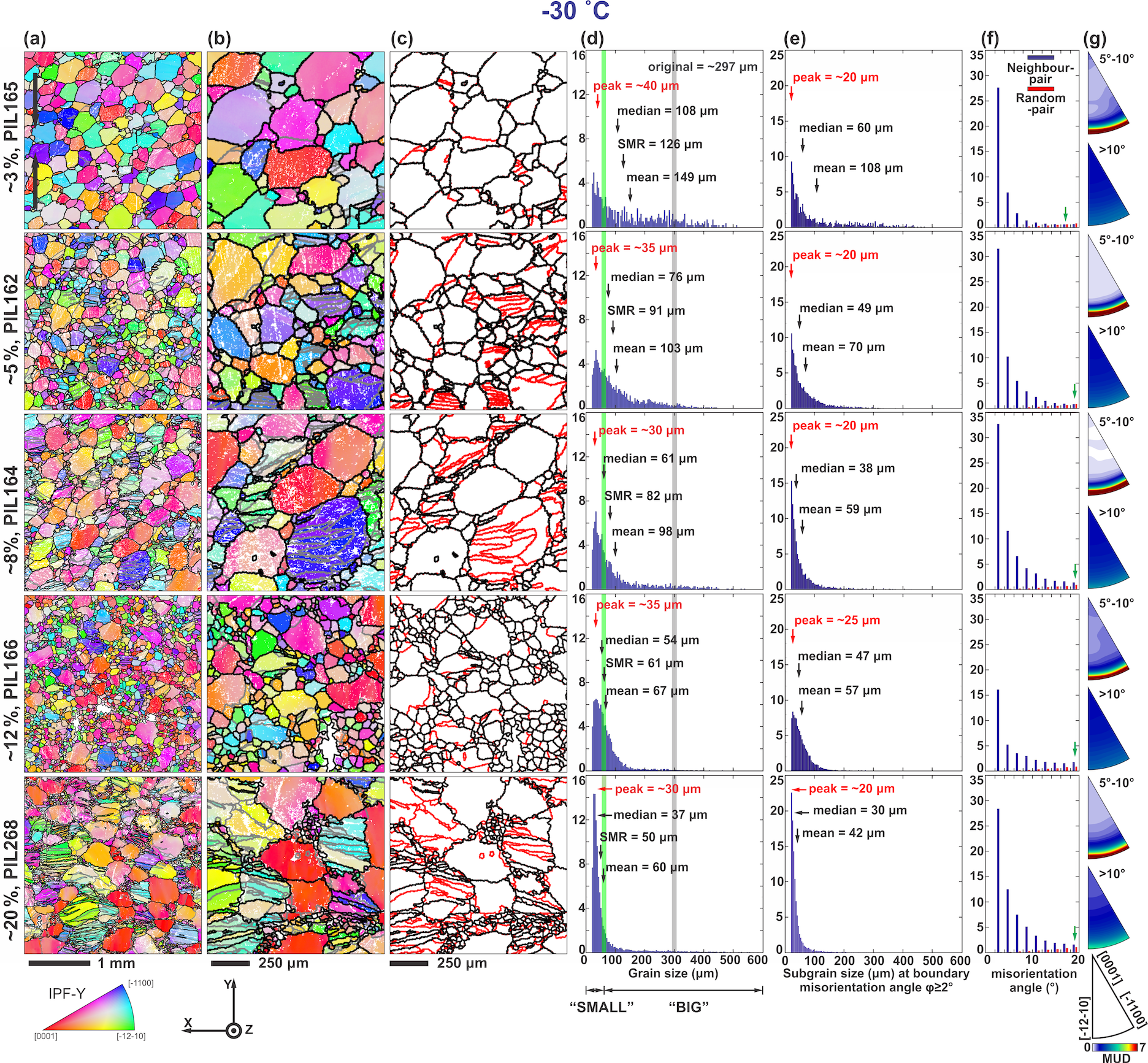

Tc Temperature And Strain Controls On Ice Deformation Mechanisms Insights From The Microstructures Of Samples Deformed To Progressively Higher Strains At 10 And 30 C

Form 1095C (21) Page 2 Instructions for Recipient You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer Form 1095C, Part IRS Releases Instructions for Forms 1094C and 1095C with Most Substantial Changes in Years On the IRS finally released its draft instructions for the Forms 1094C and 1095C Confusingly, the IRS appears to have released the final instructions the next day This is disappointing as commenters will not get to be heardElectric Sample Form No Cal P U C S/Jeet No Cal P U C S/Jeet No Authorization to Receive Customer Information or Act Upon a Customer's Behalf Advice Letter No 3015EA Decision No 1C1 Please Refer to Attached Sample Form lsslled by Brian K C/1erry Vice President Reglllatory Relations Date Filed Effective

Aca Processing 1095 B 1095 C

Selective Extraction And Determination Of Beryllium In Real Samples Using Amino 5 8 Dihydroxy 1 4 Naphthoquinone Functionalized Magnetic Mil 53 As A Novel Nanoadsorbent Rsc Advances Rsc Publishing

The IRS released for comments a draft of Form 1095C Employers will use the final version early next year to report on health coverage in The revisions add a second page to the form and may 1095C Consent 5 A popup box will appear allowing you to consent to receive the 1095C form electronically Once you give consent, you can access 1095 Cs for previous years immediately and for as soon as it is available If consent is given before 1095Cs are printed by the state, a 1095C will not be mailedSample 1095 C form for Year and later Sample 1095 C form for Year 15 to 19

2

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Www Dhcs Ca Gov Services Medi Cal Eligibility Documents Irs 1095 Form 1095b Reprint Covltr Eng Pdf

Schedule C Instructions Create A Digital Sample In Pdf

1095 C Printing Microsoft Dynamics Gp Forum Community Forum

Ez1095 Software How To Print Form 1095 C And 1094 C

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

1095 Forms 1095 Envelopes By Taxcalcusa

/88305472-ACA-reporting-56a0a45f5f9b58eba4b25f4a.jpg)

Health Care Law Reporting Requirements For Employers

Www Irs Gov Pub Irs Pdf F1095b Pdf

Amazon Ehr Com Ess Client Documents Benefitsummaries 1095 C faqs updated 1 16 17 Pdf

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Questions Employees Might Ask About 1095 C Forms Bernieportal

Http Hbex Coveredca Com Toolkit Webinars Briefings Downloads 1095 A B C Quick Guide Final Pdf

How To File 1099 S Online 1095 S Online With Efilemyforms

Www Ftb Ca Gov File Business Report Mec Info 35c Publication Draft Pdf

Mark These Dates For 19 Aca Reporting Update The Aca Times

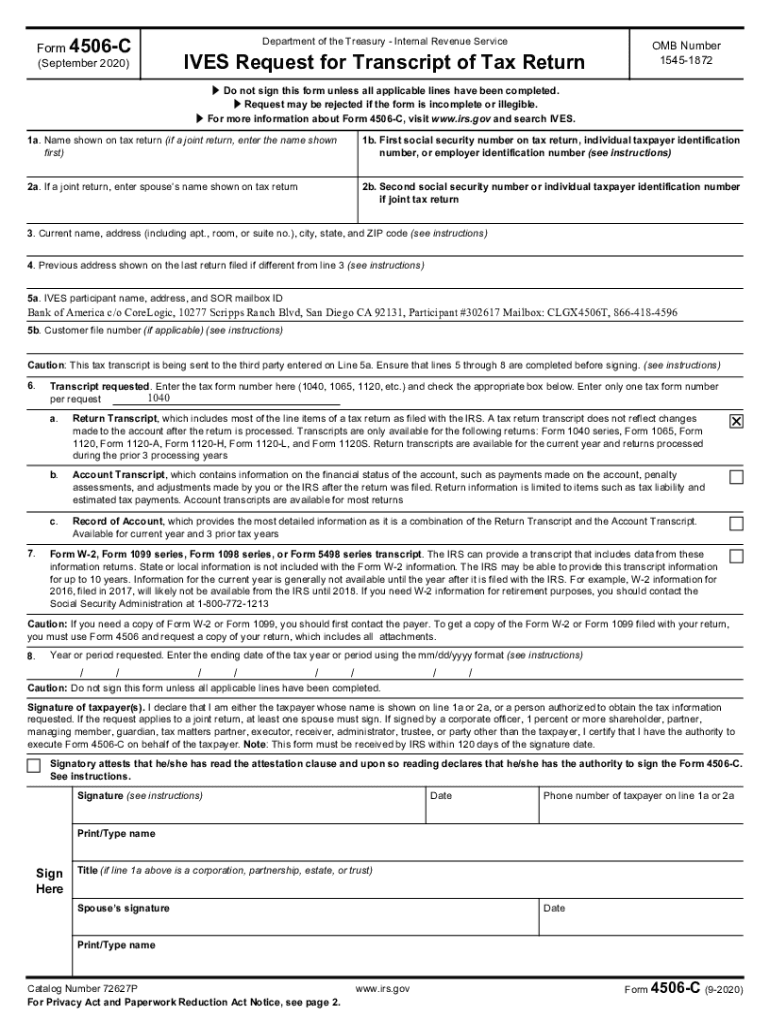

4506 C Fillable Form Fill And Sign Printable Template Online Us Legal Forms

Otr Cfo Dc Gov Sites Default Files Dc Sites Otr Publication Attachments Dc health care info returns Pdf

Form 1095 A 1095 B 1095 C And Instructions

Info Nystateofhealth Ny Gov Sites Default Files a guide to form 1095a english Pdf

390 Best W2 Forms Ideas In 21 W2 Forms Form Tax Forms

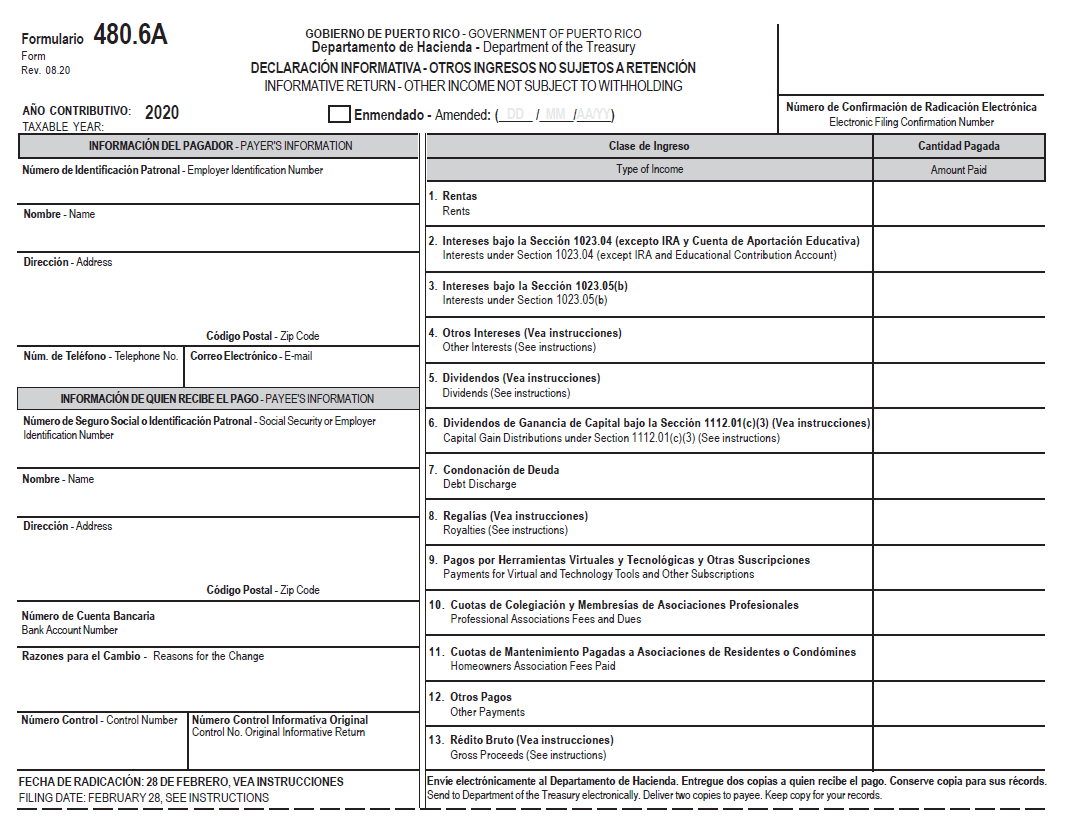

480 6a Public Documents 1099 Pro Wiki

2

1095 C 15 Pdf

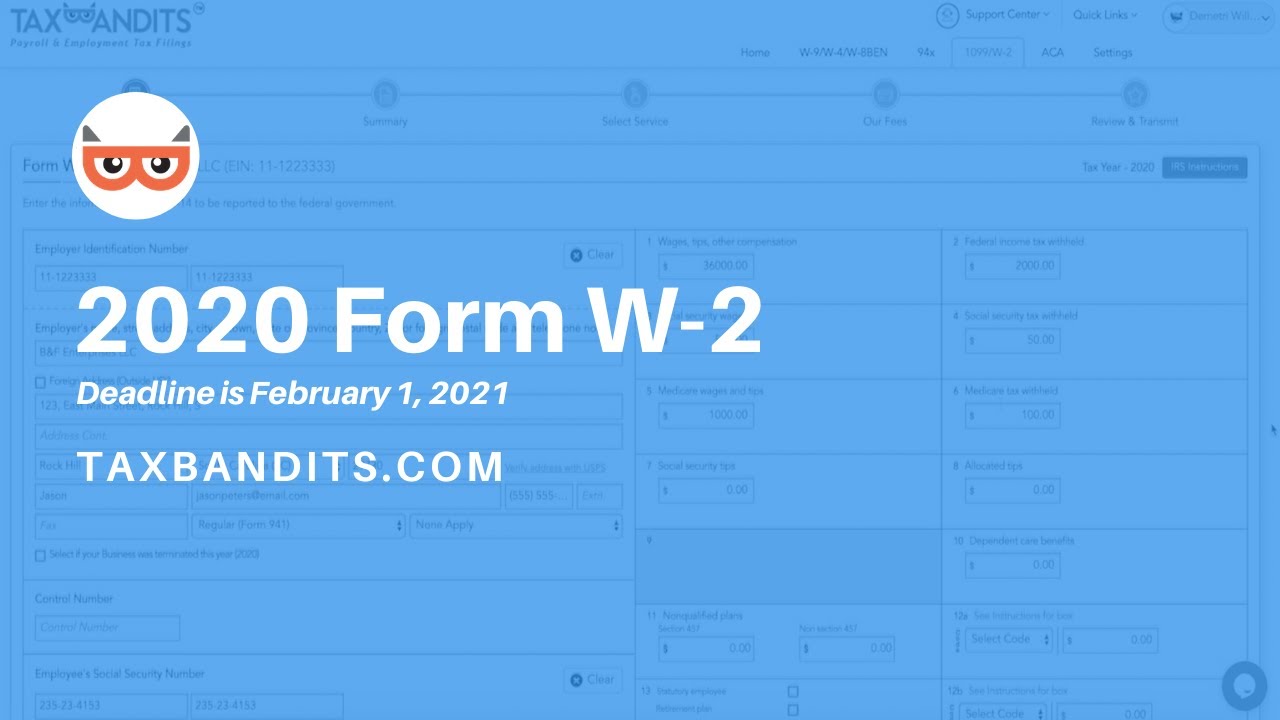

Instructions For Forms 1095 C Taxbandits Youtube

trix 1095 C Efiling Process

Irs Release Drafts Of Irs Forms 1094 C And 1095 C The Aca Times

Irs Issues Draft Form 1095 C For Aca Reporting In 21

New 1095 C Form 18 Models Form Ideas

Aca 1095 C Basic Concepts

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Covered California Ftb 35 And 1095a Statements

Otr Cfo Dc Gov Sites Default Files Dc Sites Otr Publication Attachments Dc health care info returns Pdf

Pro Ware Llc Aca 1095 Reporting

Www Ceridian Com Ceridian Media Files Resources Qepacketdf Pdf

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

:max_bytes(150000):strip_icc()/Screenshot31-f811e886d8fd4dc183e95ee360004fb3.png)

Irs Form 1099 A What Is It

Www Gadoe Org Technology Services Pcgenesis Documents Aca Test File Submission Pdf

Instructions For Forms 1095 C Taxbandits Youtube

Form Irs 1095 B Fill Online Printable Fillable Blank Pdffiller

Tax Information Access Health Ct

Aca Elite Generate Codes E File 1095 C Forms

/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png)

Form 1098 Mortgage Interest Statement Definition

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 62 Premium Tax Credit Definition

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Crystal Chemistry And Microfeatures Of Gadolinite Imprinted By Pegmatite Formation And Alteration Evolution

Http Www Healthreformbeyondthebasics Org Wp Content Uploads 16 03 Premium Tax Credit Tips And Tricks Pdf

Aca Reporting Tip 19 Self Funded Plans Usi Insurance Services

1095 C 15 Pdf

Updated Hr S Guide To Filing And Distributing 1095 Cs Bernieportal

W9 Blank Form Calendar Template Printable Throughout Free Printable 21 W 9 Form In 21 Tax Forms Calendar Template Personal Calendar

Vehi Org Client Media Files 19 Small Sds Sus Reporting Information Guide 1094 95 B Forms Finalv3 Pdf

Tmlhealthbenefits Org Forms Tml Displaydoc Aspx Doc Id 694 Form Webinar

Form 1095 C Forms Human Resources Vanderbilt University

1095 C Electronic Consent News Illinois State

Www Irs Gov Pub Irs Prior Ib 19 Pdf

How Do I Fix My 1095 Tin Validation Failed Correction Needed Forms Yearli Guide

Irs Form 62 Download Fillable Pdf Or Fill Online Premium Tax Credit Ptc Templateroller

How To Calculate Federal Income Withhold Manually With New W4 Form

1095 C Form 18 Lovely Amazon Flex 1099 Forms Schedule C Se And How To File Taxes Form Q Models Form Ideas

Resource Center

Form 1095 A 1095 B 1095 C And Instructions

1099 Misc Software 2 Efile 449 Outsource 1099 Misc Software

Instructions For Forms 1095 C Taxbandits Youtube

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

1095 Forms 1095 Envelopes By Taxcalcusa

Www Irs Gov Pub Irs Prior F1095c 15 Pdf

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Aca Code Cheatsheet

Making Sense Of Irs Form 1098 What You Need To Know Tms Tms Grow Happiness

Tmlhealthbenefits Org Forms Tml Displaydoc Aspx Doc Id 694 Form Webinar

Deadlines Loom As Employers Prep For Aca Reporting In

7 Must Know 21 Hr Compliance Dates Workest

Aca Forms 1094 C And 1095 C And Reporting Instructions For The Aca Times

Www Irs Gov Pub Irs Pdf F1095c Pdf

Understanding Your Form 1099 R Msrb Mass Gov